Five Years of Metals: Markets, Trends, and Shifts

19 August 2025This paper is part of a series that analyses the results of the 2024 Energy Institute Database (formerly BP Statistics). What Has Happened in the Last 5 Years – Metals examines the supply of metals, with a focus on rare earth elements, given their importance in the energy transition.

Classification of Metals

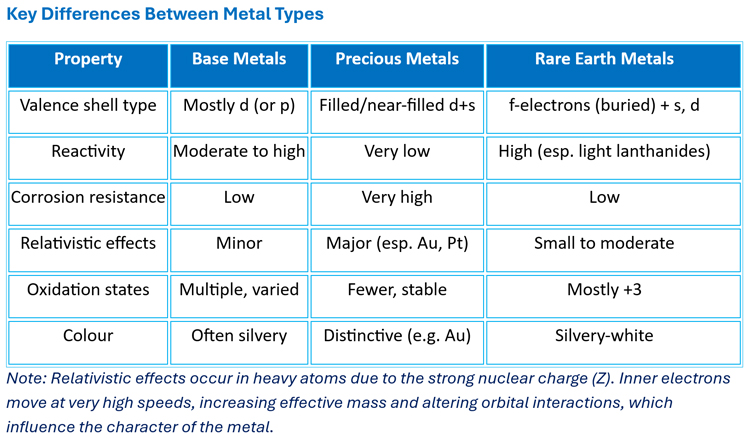

Metals can be broadly classified as base metals, precious metals, or rare earth metals. Their electronic structure determines their chemical properties, as outlined below.

1. Base Metals

Examples include iron (Fe), copper (Cu), nickel (Ni), and zinc (Zn). They are generally moderately reactive and prone to oxidation/corrosion. Their electron configurations usually end in partially filled d-orbitals (transition metals) or p-orbitals (post-transition metals). Transition metals such as Fe, Ni, and Cu have incompletely filled d-subshells, which give rise to multiple oxidation states due to the similar energies of (n-1)d and ns orbitals.

2. Precious Metals

Examples include gold (Au), silver (Ag), platinum (Pt), and palladium (Pd). They are generally much less reactive than base metals and show high resistance to oxidation and corrosion. Their electron configurations often feature filled or nearly filled d-subshells, giving them extra stability.

3. Rare Earth Metals

Rare earth metals include the lanthanides (La–Lu) and sometimes scandium (Sc) and yttrium (Y). They are generally highly reactive, particularly the lighter lanthanides. Their electron configurations are characterised by filling of 4f-orbitals (lanthanides) or 5f-orbitals (actinides). The 4f electrons are poorly shielded and do not strongly contribute to bonding, so chemical behaviour is dominated by outer 5d and 6s electrons.

Characteristics and Uses

- Base metals are abundant, lower-value metals that oxidise or corrode relatively easily. They are widely used due to their affordability and properties.

- Examples: Iron – construction, vehicles; Copper – wiring, plumbing; Aluminium (Al) – aerospace, packaging; Zinc (Zn) – galvanisation; Lead (Pb) – batteries, shielding; Nickel (Ni) – stainless steel, batteries; Tin (Sn) – solder, plating.

- Precious metals are rare, high-value metals with strong resistance to corrosion, often used in jewellery and investment.

- Examples: Gold – currency, jewellery, electronics; Silver – jewellery, solar panels; Platinum – catalytic converters; Palladium – catalytic converters, electronics; Rhodium and Ruthenium – niche industrial and jewellery uses.

- Rare metals (including rare earths and others like lithium, cobalt, tantalum, niobium, indium) are critical in high-tech, renewable energy, and defence sectors. They are often mined as by-products and are characterised by essential applications, strategic supply chains, and rising demand during the clean energy transition.

Rare Earth Metals and the Energy Transition

Electrification during the energy transition will increase demand for both mainstream and specialised metals, especially rare earths. These elements, primarily the lanthanides, are critical in manufacturing high-tech devices and clean energy technologies. Scandium and yttrium are also considered due to similar properties and co-occurrence.

Examples of uses: Neodymium, praseodymium, and dysprosium in magnets for wind turbines, EV motors, and hard drives; dysprosium, terbium, and yttrium in lighting and displays; lanthanum and cerium in rechargeable batteries.

Despite their name, rare earths are not geologically rare. Some are more abundant than common metals such as copper or lead. For example, cerium is the 25th most abundant element in the Earth’s crust. The term “rare” originated from their initial discovery in rare minerals in the 18th century. Their rarity lies in economically viable deposits and the difficulty of separation due to similar chemical properties.

Production and Processing Capacity

China dominates rare earth production with ~270,000 metric tonnes in 2025 and controls ~90% of global refining and separation capacity, including magnet manufacturing. The US (45,000 tonnes), Myanmar (31,000 tonnes), and Australia (13,000 tonnes) follow distantly.

Outside China:

- Australia: Lynas (Mt Weld mine; separation in Malaysia); Iluka building Eneabba refinery (65,000 t annual capacity, operations ~2027).

- US: MP Materials (Mountain Pass mine); produced 1,300 t NdPr oxide in 2024; expansion includes a Texas magnet plant (1,000 t/year target).

- UK: Pensana’s Saltend facility (4,500 t/year NdPr oxide, ~5% of global demand).

- Brazil and others: Developing new mines and processing projects.

China’s dominance is seen as a strategic risk, particularly as it employs export restrictions. Other nations are diversifying supply chains through policy support and heavy investment.

Mine Development Timelines

Mine development is typically protracted:

- Best case (favourable jurisdictions, good infrastructure): 7–10 years.

- Challenging jurisdictions or remote/complex deposits: 10–15 years.

- Some projects: 20+ years due to political, environmental, or market hurdles.

Conclusion

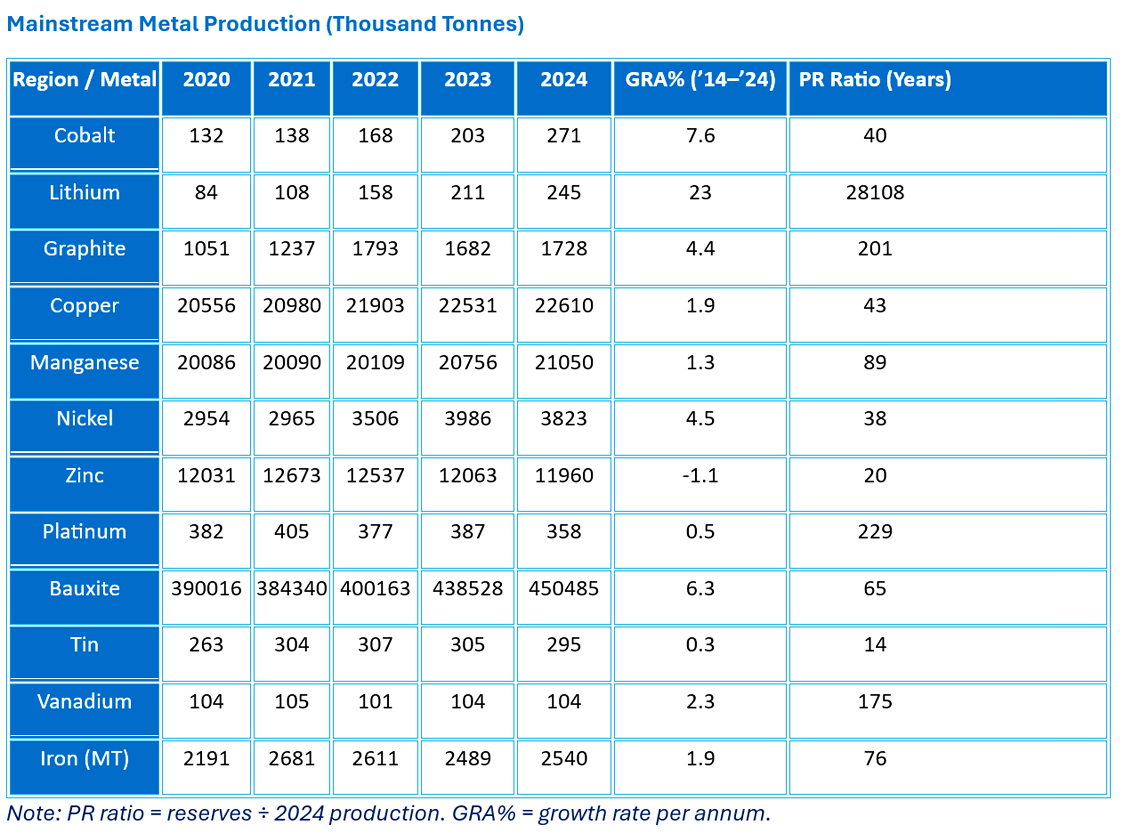

Tin and zinc show tightening reserve-to-production ratios. Tin is often in small, scattered deposits, with artisanal mining common. Large mechanised mines face environmental challenges. Zinc, often mined alongside other metals, may benefit from shared infrastructure.

Cobalt and copper could become problematic in the medium term due to geographic concentration: ~70% of cobalt reserves and production are in the Democratic Republic of the Congo, while most copper reserves are in Chile and Peru.

Rare earth elements remain strategically critical, with China maintaining near-monopoly control. Other nations are expanding capacity, but development will take time.